News

US AML Enforcement Rebounded in 2022, Though Penalties Dropped

After hitting a record low in 2021, federal enforcement of U.S. anti-money laundering rules rebounded moderately in terms of volume in 2022 but the aggregate value of AML-related regulatory penalties dropped, data compiled by ACAMS moneylaundering.com shows.

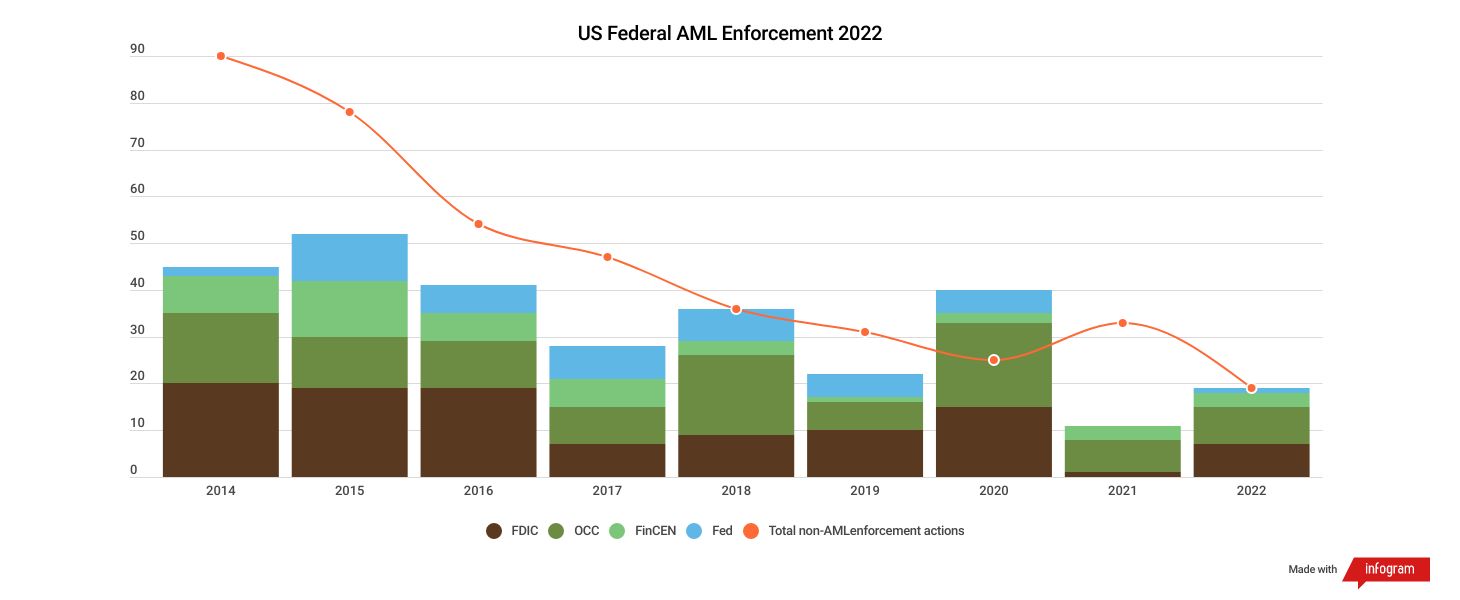

All told, the Office of the Comptroller of the Currency, Financial Crimes Enforcement Network, Federal Deposit Insurance Corp. and Federal Reserve finalized 19 enforcement actions last year in response to AML infractions, nearly double their final tally of 11 such actions in 2021 but still far below the 40 that they logged in 2020.

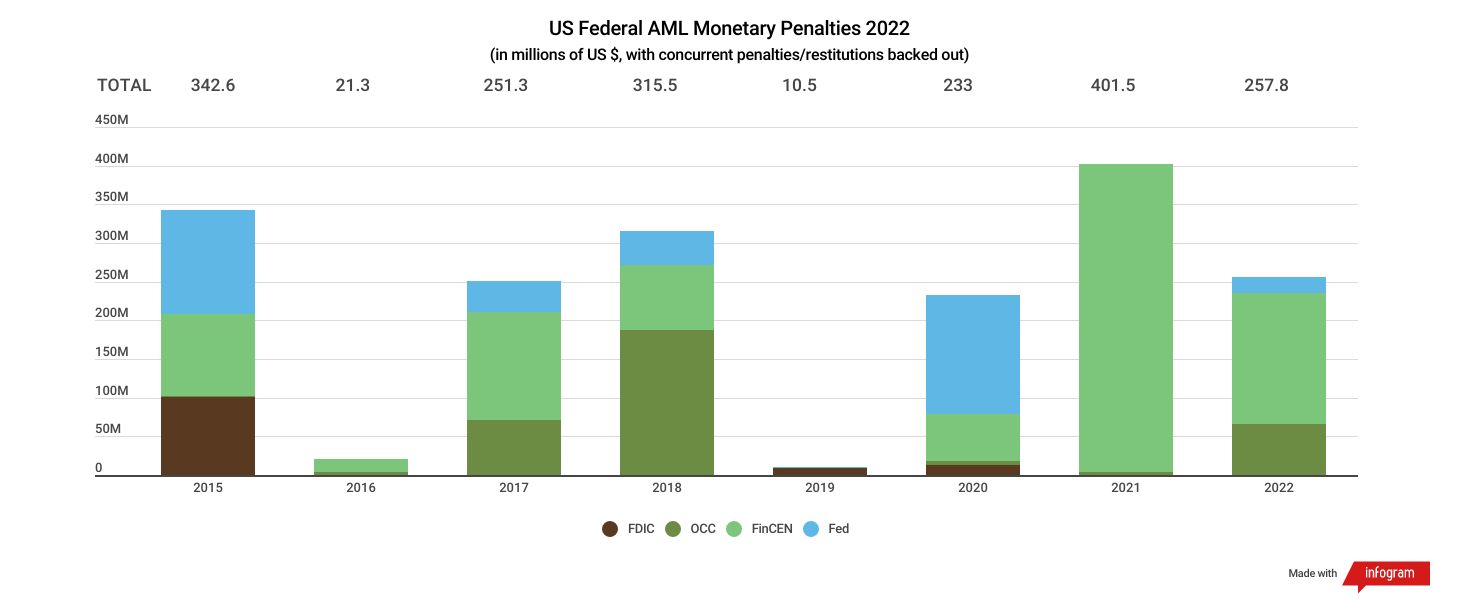

Eight of the 19 AML-related actions finalized by the OCC, FinCEN, FDIC and Fed last year carried a combined $384 million in penalties against individuals and institutions, as compared to six AML-related actions for $403 million in 2021 and 20 for $233 million in 2020.

The total number of enforcement actions taken in response to breaches of all types, including violations of AML rules, sanctions, lending requirements, safety-and-soundness standards and other obligations, dropped from 44 in 2021 to only 38 in 2022, with AML comprising half of last year’s total.

FinCEN and the OCC’s assessment of $140 million in combined penalties against Texas-based USAA Federal Savings Bank in March topped the list of AML-related monetary outlays in 2022, followed by the Federal Reserve’s extraction of $20.4 million from the National Bank of Pakistan the month prior.

The OCC issued a consent order to Blue Ridge Bank in Martinsville, Virginia, in August, requiring the lender to measure and manage the risks presented by the bank’s “third-party fintech [financial technology] relationships,” including by building an AML program that covers “all products, services, customers, entities and geographies.”

“This is one of the few BSA/AML enforcement actions taken by the OCC that specifically addresses third-party risk management,” said James Vivenzio, the regulator’s former director of AML policy. “As bank reliance on third-party fintech relationships continues to expand and develop, this is going to be a trend going forward.”

The OCC assessed a $6 million penalty against Sterling Bank and Trust in September for failing to adhere to AML and safety-and-soundness requirements, 16 months after three former employees of the Michigan-based lender pleaded guilty to knowingly approving loans to parties tied to money laundering and tax evasion.

FinCEN and the Treasury Department’s Office of Foreign Assets Control, or OFAC, then ordered Bittrex, a cryptocurrency platform in Seattle, to pay $29 million in penalties the following month for willfully violating sanctions and AML rules, including by handling transactions for parties in Iran and Russian-occupied Crimea.

One of the most remarkable penalties of the year in terms of impact was among the smallest in terms of value: In April, FinCEN fined A&S World Trading Incorporated, owner of a retail perfume shop in Los Angeles, $275,000 for failing to flag at least 114 payments of more than $3,000 in 2014 and 2015 in violation of a geographic targeting order in effect during that time.

The penalty against A&S not only marked the first against a non-bank company for violating a GTO, but also signaled FinCEN’s readiness to actively enforce lesser-known requirements under the Bank Secrecy Act, Braddock Stevenson, former deputy associate director of the bureau’s enforcement division, told moneylaundering.com last year.

The Commodity Futures Trading Commission fined bZeroX, the provider of decentralized, blockchain-based software that functioned like a trading platform, $250,000 in September for failing to implement a customer identification program, among other shortcomings.

CHS Hedging, a Minnesota-based futures commission merchant, triggered a $6.5 million penalty from the CFTC in December for violating AML rules.

The FDIC did not finalize a single AML-related action for the second straight year in 2022.

“If you lump all [the enforcement statistics] together you can see certain trends, but that’s not the way regulators look at it,” said Ross Delston, a St. Louis-based attorney, anti-money laundering specialist and former assistant general counsel with the FDIC. “They’re just looking at financial institutions over which they have jurisdiction.”

Six of the 13 penalties, disgorgements and other monetary resolutions disclosed by the Justice Department or New York’s Department of Financial Services in 2022 covered AML infractions, for a combined $2.1 billion in outlays, up from $357 million in 2021.

In conjunction with the Federal Reserve’s action against the National Bank of Pakistan in February, DFS fined the bank $35 million after finding evidence of “serious” transaction-monitoring issues, “significant” managerial shortcomings and other compliance-related flaws.

The regulator then finalized a consent against MoneyGram International, pursuant to which the company agreed to pay $8.3 million after six of the company’s agents in Queens and elsewhere in New York City remitted tens of millions of dollars to China without property scrutiny.

DFS penalized a virtual asset service provider for the first time in August, fining Robinhood Crypto $30 million in response to “significant violations” of AML and cybersecurity rules.

“It’s apparent that DFS is prioritizing virtual currency and cybersecurity investigations, which fits the needs of the times and aligns with federal regulators,” Linda Lacewell, who led the agency from February 2019 to August 2021, told moneylaundering.com. “Of course, all regulators need to continue investing resources to detect … global money laundering as well.”

The lion’s share of money laundering still involves large foreign banks, some of which operate in New York, said Lacewell. “That hasn’t changed.”

Sanctions and Securities

After finalizing 19 actions in 2021 and collecting $20.8 million in penalties, including a combined $13.8 million from seven financial institutions, OFAC disclosed 14 penalties for more than $43 million in 2022.

Nine of those fourteen penalties targeted financial institutions, led by the agency and FinCEN’s extraction of $29 million from Bittrex, the Seattle-based cryptocurrency platform, in October.

The Securities and Exchange Commission meanwhile finalized 14 enforcement actions in 2022 in response to violations of anti-financial crime and cybersecurity rules for a combined $1.7 billion in penalties, forfeitures, disgorgements and other outlays, after completing 12 actions for only $195 million in 2021.

The Financial Industry Regulatory Authority finalized eight enforcement actions, all of which targeted individuals caught violating AML rules.

The Justice Department led the pack last year in terms of AML-related monetary outlays, tagging Denmark’s Danske Bank with a combined $2.8 billion in monetary outlays in December for tricking U.S. banks into processing tens of billions of dollars’ worth of suspicious payments and hiding flaws with the lender’s compliance program in Estonia.

Danske Bank also paid $413 million to the SEC as part of the case.

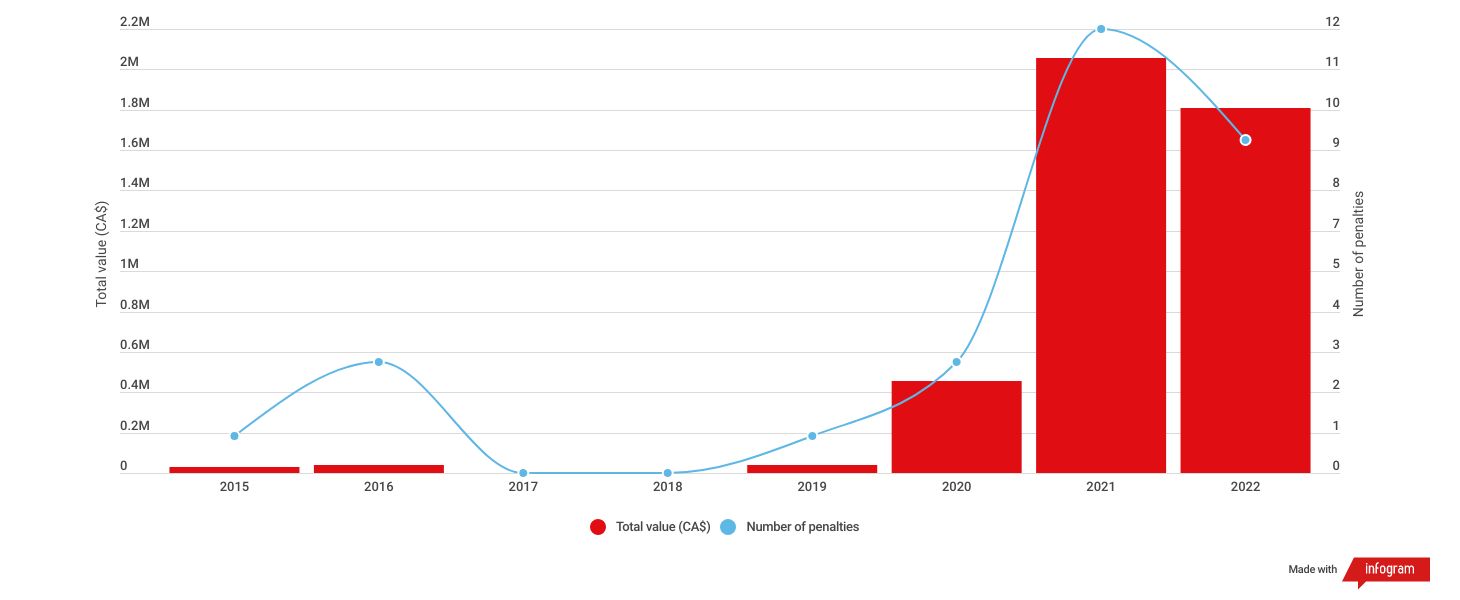

Canada

The Financial Transactions and Reports Analysis Centre of Canada issued 14 AML-related penalties for a combined U.S. $1.8 million in 2022, up from nine for $1.2 million in 2021 and two for $353,000 in 2020.

Fintrac assessed its largest penalty of the year in April, fining Laurentian Bank of Canada $363,000 for failing to report suspicious transactions.

Stephane Sirard, assistant director of Fintrac’s compliance sector, identified illicit finance through real estate as a top priority for the agency, which completed eight actions against property agencies and other firms within the sector last year.

“Generally speaking, the real estate sector doesn’t have the culture of compliance that you will find in the banking sector, for example,” Sirard said. “We’ve seen significant gaps in terms of client ID, record keeping and also filing STRs [suspicious transaction reports].”

Real estate companies filed 256 STRs in 2022 after filing only 126 the previous year.

Fintrac also prioritized supervision of money services businesses for AML purposes in 2022, Donna Achimov, the agency’s chief compliance officer, told moneylaundering.com.

“We’ve been very, very proactive with revocations in the past year,” Achimov said. “We use social media, we fan out and we make sure that financial institutions and other stakeholders who are impacted by MSBs are aware of the problem.”

Colby Adams, Kieran Beer, Junko Nozawa, Larissa Bernardes, Leily Faridzadeh and Silas Bartels contributed to this article.

| Topics : | Anti-money laundering , Counterterrorist Financing , Sanctions , Cryptocurrencies |

|---|---|

| Source: | U.S.: OCC , U.S.: FDIC , U.S.: Federal Reserve Board , U.S.: FinCEN , U.S.: OFAC , U.S.: NYS Department of Financial Services , U.S.: SEC , U.S.: Finra (NASD/NYSE) , U.S.: Department of Justice , Canada , Canada: FINTRAC |

| Document Date: | May 8, 2023 |