News

US AML Enforcement Hit New Low in 2019 as New York Took Center Stage … Again

U.S. enforcement actions against institutions and individuals caught violating anti-money laundering rules dropped to a record low again in 2019, sanctions enforcement stayed robust and a state regulator, New York’s Department of Financial Services, or DFS, slapped the industry for hundreds of millions of dollars in penalties.

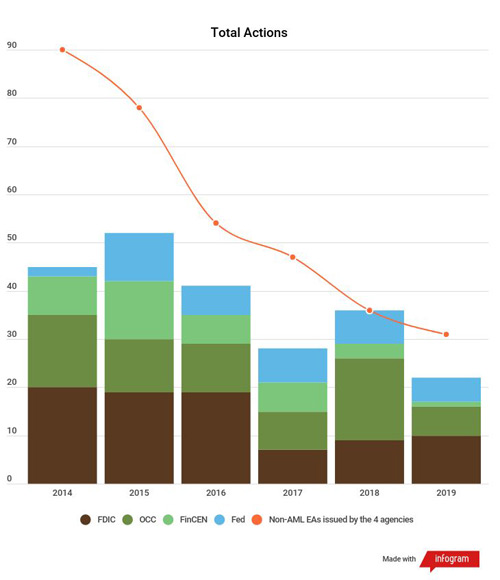

Amid a backdrop of increased enforcement across the globe and especially in Europe, the U.S. Financial Crimes Enforcement Network, Office of the Comptroller of the Currency, Federal Reserve and Federal Deposit Insurance Corp. concluded only 22 AML enforcement actions last year, down from the 36 they completed in 2018 and their previous low of 28 in 2017, according to data compiled by ACAMS moneylaundering.com.

New York’s DFS concluded only one AML-related action in 2019 but assessed the largest AML-related regulatory penalty in the United States for the fourth year running in April, fining Standard Chartered Bank $180 million for many of the same problems that led to the lender’s $340 million settlement with DFS seven years prior.

“I think at DFS you saw a shift in priorities,” said Matt Levine, the regulator’s former executive deputy superintendent for enforcement. “It’s not that they were no longer interested in BSA, AML or OFAC [the Treasury Department’s Office of Foreign Assets Control.] It’s that they also elevated the importance of consumer-facing interest investigations.”

Standard Chartered’s payment to DFS came as part of a $1.1 billion settlement pursuant to which the bank also agreed to cede hundreds of millions of dollars to the U.S. Justice Department, Treasury Department and Manhattan District Attorney’s Office, as well as £102 million to the U.K. Financial Conduct Authority.

In 2013 and 2014, an independent monitor identified serious flaws in how the bank screened transactions, according to DFS. The settlement also included an outlay of nearly $164 million to the Federal Reserve for sanctions violations.

“The monitor determined that rules governing the transaction-monitoring system failed to detect a significant number of potentially high-risk transactions that should have been subjected to further review by compliance staff,” DFS concluded.

DFS separately extracted $33 million from the Bank of Tokyo-Mitsubishi UFJ after the regulator accused the lender of switching to a federal charter to avoid investigation for sanctions and compliance infractions.

“I think the priority now is to have a very good risk assessment in place,” said Luis Cifuentes, chief compliance officer for Banco Bradesco in New York. “They want an ongoing risk assessment … they want you to be able to say: ‘my customer risk base is x, I have x percent of high risk customers.'”

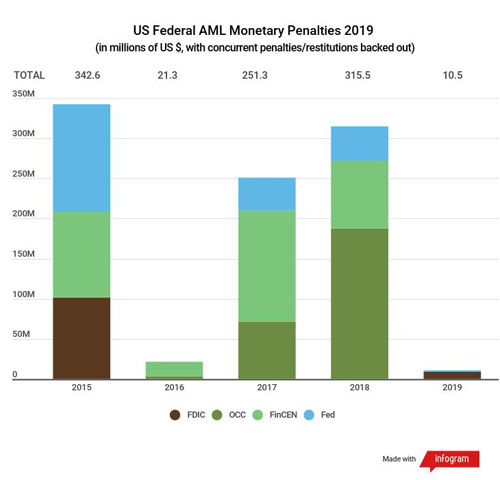

Only six of last year’s 22 federal AML enforcement actions came with penalties as total, nonconcurrent regulatory outlays for such infractions dropped from more than $315 million in 2018 to a new low of $10.5 million.

The FDIC’s $7.5 million penalty against Wilmington, Delaware-headquartered Bancorp Bank for violating the Bank Secrecy Act comprised the vast bulk of that total, followed by the Federal Reserve’s $1.4 million penalty against former Goldman Sachs banker Tim Leissner for his involvement in the 1MDB embezzlement and money laundering scandal.

California Pacific Bank agreed to pay $225,000 to the FDIC after the regulator determined that the San Francisco-based lender breached the terms of a 2016 cease and desist order, and Alma Bank of Astoria, New York, consented to a $1.3 million civil money penalty for again violating the Bank Secrecy Act.

FinCEN assessed its only monetary penalty in April, fining Eric Powers, an unlicensed peer-to-peer cryptocurrency exchanger in California, more than $35,000 for violating the Bank Secrecy Act and barring him from engaging in money transmission.

The OCC’s only AML penalty of 2019 also targeted an individual.

In March, the agency ordered the former general counsel of Rabobank’s affiliate in California, Daniel Weiss, to pay a $50,000 civil monetary penalty, six years after he made false statements to the regulator and concealed an incriminating audit of the bank’s compliance program.

Italy’s UniCredit Group agreed to pay federal and state agencies, including the Federal Reserve and DFS, $1.3 billion after conceding that its affiliates in Germany and Austria helped Iran and other countries circumvent sanctions by moving hundreds of millions of dollars through U.S. bank accounts.

The National Credit Union Administration issued industry bans against three individuals in 2019, including Julie Ann Turk, a former employee of Allentown Federal Credit Union in Pennsylvania, who was sentenced to 30 months in prison for bank fraud, embezzlement and money laundering.

In March, the Commodity Futures Trading Commission ordered Marshall Islands-based 1pool Ltd. and its owner, Patrick Brunner, to pay a $175,000 fine and disgorge $246,000 in profits for illegally offering retail commodity transactions margined in bitcoins and failing to establish an AML program.

Examiners also prioritized compliance with FinCEN’s customer due-diligence rule in 2019.

“The biggest area of focus that I have seen has been … CDD and EDD [enhance due diligence] processes, as well as compliance with the updates to the federal exam manual in 2018 for CDD, and, to a lesser extent, compliance with its beneficial ownership requirements,” a compliance officer for a regional lender on the West Coast told moneylaundering.com.

The Financial Industry Regulatory Authority completed 11 AML-related enforcement actions in 2019, and all but one carried a penalty.

FINRA’s most significant action in terms of value and volume came in October, when the regulator ordered French lender BNP Paribas’ two securities-trading affiliates in New York to pay $15 million for failing to review penny stocks for AML purposes and neglecting to screen tens of thousands of wire transfers from high-risk jurisdictions.

Five months earlier, FINRA canceled Windsor Street Capital’s membership and fined the New York brokerage $1 million for violating AML rules and charging clients excessive fees.

FINRA’s federal counterpart, the Securities and Exchange Commission, concluded only two AML-related actions in 2019, collecting $300,000 from Wilson-Davis & Co. and $625,000 from Financial Markets LLC for violating requirements to report suspicious activity.

But the regulator ended the year by barring Leissner, the former Goldman Sachs banker, from the industry for violating the Foreign Corrupt Practices Act in his dealings with 1MDB, the Malaysian sovereign wealth fund at the center of a $4 billion embezzlement and money laundering scandal.

Leissner, who agreed to disgorge nearly $44 million to the SEC, pleaded guilty to federal charges of conspiring to launder money and violate the FCPA in August 2018.

“In 2019, regulators were heavily focused on Asia,” said Fred Curry, head of Deloitte’s AML and sanctions practice. “When regulators find issues at a particular bank, they look at other banks in the region to see if the problems are similar …. they do these things in clusters because they find weaknesses in clusters.”

Six of the 26 fines that OFAC assessed in 2019 targeted financial institutions.

OFAC disclosed its largest penalties in April, fining Standard Chartered $657 million and Unicredit’s affiliates in Austria, Germany and Italy a combined $611 million as part of both lenders’ resolutions of sanctions violations.

A month later, OFAC issued a notice of finding against State Street Bank and Trust for processing at least 45 pension payments for roughly $11,000 for a U.S. citizen who held a U.S. bank account but lived in Iran.

That OFAC issued a notice despite concluding that SSBT’s underlying conduct did not warrant a penalty demonstrates the agency’s view that firms must centralize their compliance functions, said Erich Ferrari, a sanctions attorney with Ferrari & Associates in Washington, D.C.

“With respect to the UniCredit and Standard Chartered cases, I don’t believe there was a whole lot of new lessons in there,” Ferrari said. “They involved the obfuscation of sanctioned parties or jurisdictions in payments processed through U.S. intermediaries or branches—conduct that we have seen penalized or addressed by OFAC in the past.”

In addition to the Justice Department securing AML and sanctions settlements with Standard Chartered and UniCredit and fining five other institutions for tax infractions, for one of the first times ever, the U.S. Attorney’s Office for the District of Columbia, cited BSA violations in seizing funds routed through U.S. correspondent accounts by North Korean and Iranian entities.

The violations in question pertain to FinCEN’s termination of all correspondent banking activities for North Korea in 2016 and Iran in 2019.

“We specifically alleged that foreign front companies were causing U.S. banks to process transactions they would have refused if they knew of their true nature,” Zia Faruqui, assistant U.S. attorney for the District of Columbia, told moneylaundering.com in an email. “As such, the funds involved in these transactions and related transactions constituted bank fraud.”

Colby Adams, Kieran Beer, Larissa Bernardes, Laura Cruz, Leily Faridzadeh and Silas Bartels contributed to this article.

| Topics : | Anti-money laundering , Counterterrorist Financing , Sanctions |

|---|---|

| Source: | U.S.: Department of Justice , U.S.: Department of Treasury , U.S.: Federal Reserve Board , U.S.: FinCEN , U.S.: Finra (NASD/NYSE) , U.S.: Manhattan District Attorney , U.S.: OFAC , U.S.: SEC |

| Document Date: | April 27, 2020 |